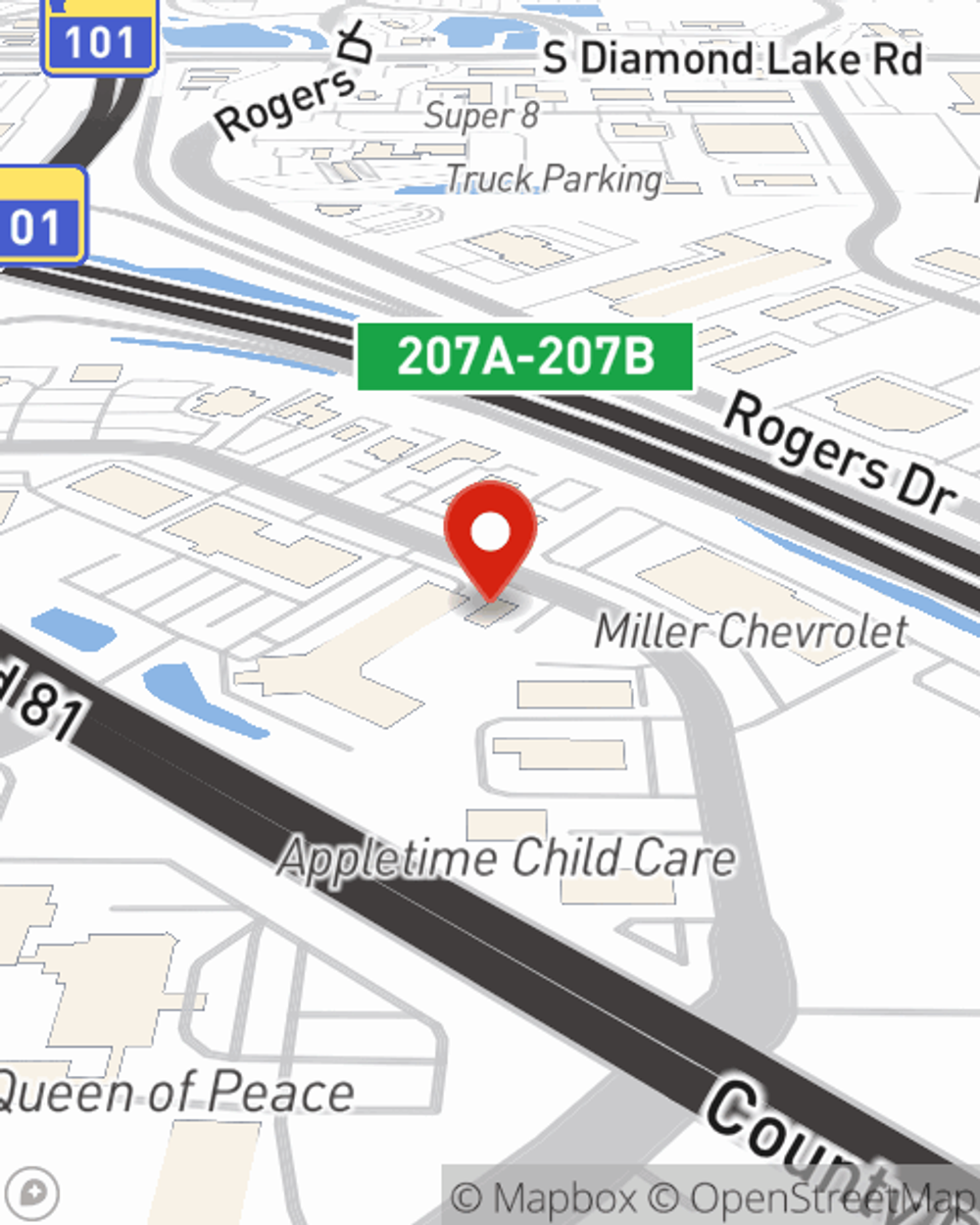

Business Insurance in and around Rogers

Looking for small business insurance coverage?

No funny business here

- Rogers

- St. Michael

- Otsego

- Maple Grove

- Hannover

- Dayton

- Elk River

- Plymouth

- New Hope

- Osseo

- Ramsey

Your Search For Excellent Small Business Insurance Ends Now.

As a business owner, you have to think about all areas of business, all the time. The details can be overwhelming! You can maximize your efforts by working with State Farm agent Andy Hedlund. Andy Hedlund understands where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your concerns and frees you to focus on growing your business into the future.

Looking for small business insurance coverage?

No funny business here

Protect Your Business With State Farm

Whether you are a piano tuner a veterinarian, or you own a bridal shop, State Farm may cover you. After all, we've been helping small businesses grow since 1935! State Farm agent Andy Hedlund can help you discover coverage that's right for you and your business. Your business policy can cover things such as equipment breakdown and money.

Get in touch with the wonderful team at agent Andy Hedlund's office to uncover the options that may be right for you and your small business.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Andy Hedlund

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.